Move beyond traditional voluntary products and introduce your clients to custom plans designed to fit their specific needs. As we discussed last month, in an age where the most successful advisers are those willing to adjust, adapt and embrace change, a key factor in each broker’s performance is their approach to enhanced (voluntary) benefits. Whether you entrust one carrier with …

Voluntary Disruption: Part 3

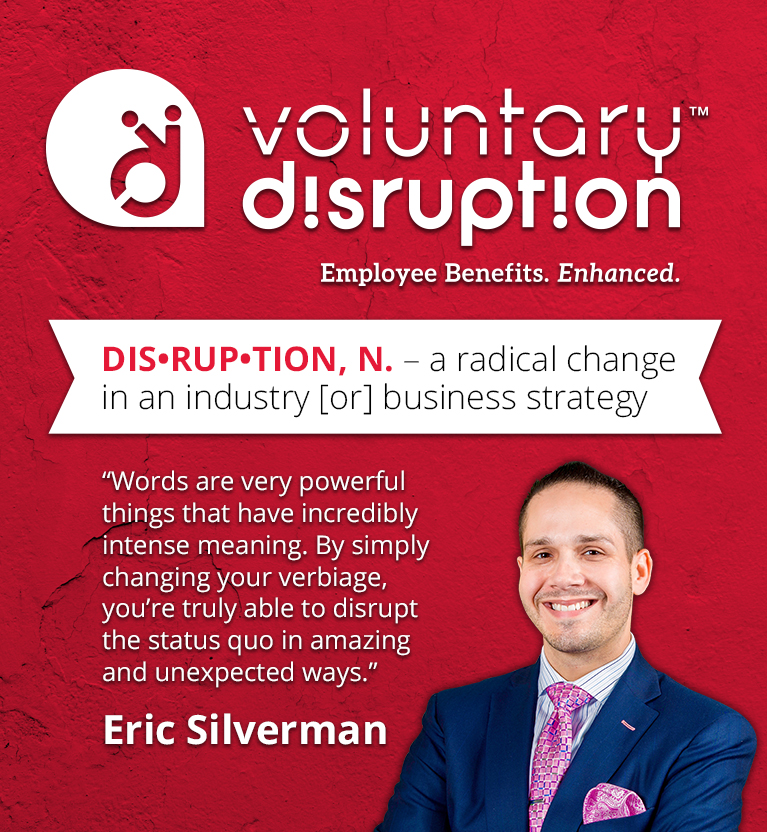

It’s the advisor that must learn to adjust, adapt and accept an industry that is changing daily To “disrupt,” according to dictionary.com, is a verb used to express “disorder or turmoil,” while to cause “disruption,” is a noun that in business means to bring “radical change in an industry [or] business strategy.” Let’s continue disrupting the enhanced benefits space, or …

Which Type of Enhanced Benefits Broker Are You?

Most brokers fall into one of four categories, and two of them could set you up to disappoint clients and potentially lose their business, while also leaving valuable revenue on the table. Last month, we discussed three best practices to achieve success in open enrollment, but even the best-laid plans must evolve over time to reflect the changing marketplace. This …

3 Easy Ways to Succeed During Your Next Enhanced Benefits Open Enrollment

Be service-oriented, emphasize the value of enhanced products before open enrollment begins, and treat each client like a new, warm prospect. Despite our best efforts, we’ve all had open enrollments go awry. Last month, I emphasized how the words you use to speak about enhanced benefits will impact employees’ perception of their value. Word choice is just one factor that …

Voluntary Disruption: Part 2

Eliminating redundancies, avoiding over-spends and heading off commission-grabs Last time, I discussed how the most influential disrupter to the enhanced benefits industry must be the willingness of the broker community at large, to adjust, adapt, and embrace our ever-changing market. How brokers must position themselves as either an innovator who drives the change or an adopter who follows those innovators …

Word Choice Proves Paramount

Referring to employee-funded benefits as ‘voluntary,’ ‘ancillary,’ ‘supplemental’ and ‘worksite’ are hurting your sales. Last month, I shared how I’m on a mission to disrupt the “voluntary” industry by breaking through the health insurance status-quo that employers have been accustomed to for far too long. For me, that started with leaving the voluntary benefits carrier rep lifestyle behind, and it …

My Moment of Clarity: From Voluntary Carrier Rep to Enhanced Benefits Strategist

There is such a thing as overselling and employees being over-insured. As a voluntary benefits carrier rep – I prefer the term “enhanced benefits strategist” – I lived the sweet life for more than a decade. Year after year, I slayed the sales contests. Lavish all-expense-paid trips? I took them. Quarterly and annual bonus checks so large they looked like …

The voluntary status-quo isn’t acceptable, either

Group health brokers who sell themselves as being innovative and non-status quo continue to ignore enhanced voluntary benefits, thus serving only half their clients and arguably snubbing those who need their cost-saving strategies the most: the employees. The buzzwords of the year have all circled around the idea of not being “status quo.” Brokers everywhere are focusing on being innovative, cutting edge …

Direct employers to consider voluntary benefits

Succeeding with enhanced benefits — formerly known as voluntary benefits — involves a super simple strategy. It’s all about setting up a dedicated time with your prospect or client to discuss how enhanced benefits fit directly into their total benefits strategy. Those benefit brokers who get it, get it. But sadly, up to 95% take the wrong approach. As a …

Voluntary Disruption

Bringing the benefits portfolio out to the cutting-edge “Disruptor” is such a loaded word, isn’t it? But it is a precise description of healthcare industry thought leaders like David Contorno of Lake Norman Benefits in Mooresville, NC; Mark Gaunya of Borislow Insurance in Boston, MA; and Andy Neary of The Olson Group in Omaha, NE. These healthcare rock-stars, among many …