How can advisers use automatic benefits enrollment to better support their clients? Here’s a real-life case study provided by Matt Berger, who heads the Philadelphia market for Aflac.

An employer was seeing the bulk of its employees abuse the ER or similar urgent care facilities for mundane ailments like colds and stomachaches. The employees’ $50 copay wasn’t much more than the cost of a visit to their primary care physician, and they realized it was easier, quicker and more convenient than trying to schedule an appointment with their busy doctor’s office.

The employer’s benefits adviser proposed a two-part solution to the employer’s problem:

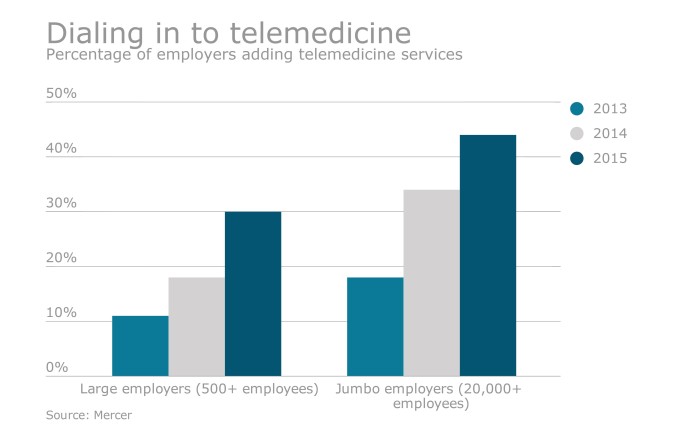

First, switch to a high-deductible health plan (HDHP) with a health savings account; raise the ER and urgent care copay to $150 per visit, but also bring in a cutting-edge telemedicine program for employees to use in lieu of going to the ER for every sniffle or tummy ache. The recommended telehealth program provides unlimited usage free of charge, and the cost per employee is nominal.

In tandem with the above, offer a comprehensive suite of voluntary benefits to compensate for the increased deductibles and copays of the new HDHP. Voluntary benefits pay cash directly to the employee when it’s needed most, thus greatly offsetting the enormous and out-of-pocket expenses that inevitably accompany a catastrophic illness or injury.

Negative enrollment

The adviser proposed to “bake” the cost of the telemedicine program into every employee’s healthcare enrollment by making use of automatic enrollment.

Auto enrollment, also known as negative enrollment, has been popularized by the 401(k) industry. Employers looking to boost their plan participation auto-enroll their employees into their retirement account. Employees are then given ample time to opt-out via an elaborate communication campaign by the company’s HR team and retirement plan broker.

Under the adviser’s plan, the new per employee bi-weekly cost for health insurance was $76 without the telemedicine feature and $80 with telemedicine included.

Whether the employee opted in or out of telemedicine, the new ER/urgent care copay was still $150 per visit. With that in mind, the adviser proposed to spearhead an elaborate communication campaign to educate the workforce on the advantages of the new healthcare program and the telemedicine offering in particular. The broker also suggested that the voluntary benefit counselors conduct the education, which would cost the employer nothing as long as the company offered at least two voluntary programs and agreed that the counselors could meet with every employee one-on-one.

These were the outcomes following the education campaign:

- Total employees = 120

- Educated one-on-one = 100%

- Telemedicine opt-out rate = <20%

How often are brokers, let alone voluntary benefit carriers, granted one-on-one access to each and every employee? The beauty of this story isn’t how many participants enrolled in VB or how much insurance premium was generated. The real takeaway is the one-on-one employee access and control that the adviser garnered with his proposals. The broker’s creativity not only allowed him to solve his client’s problem, but he was also able to compensate for the recent reductions in his health insurance commission by adding a robust voluntary benefits program. In other words, the adviser crafted a quintessential “win-win” solution for everyone involved.

There’s another lesson here as well. When planned, communicated and executed properly, a negative enrollment can become one of the most positive and lucrative enrollments that an adviser will ever carry out.